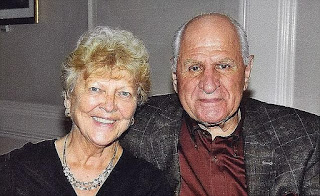

Barbara Schwartz was a Manhattan socialite who was stabbed to death by her shut-in son, Jonathan, in 2011. She was survived by second husband, Burton Fischler, the son who killed her, and a second son, Kenneth. Her estate was estimated at $6 million at the time of her death.

In the six years since her murder, her widower allegedly lost $4.3 million of her estate in six months due to poor financial management including day trading, Kenneth committed suicide in 2013 when he learned of the financial losses, and Jonathan was found not guilty by reason of insanity. Schwartz’s first husband is now in charge of the estate and has sued to stop Kenneth from inheriting her estate. Got it? Jonathan killed her and survived. Kenneth did not kill her and committed suicide.

As if that is not complicated enough, Fischler is now challenging the pre-nup he and Schwartz signed in 2000. He claims that he signed it under pressure from her family and that he received bad legal advice. He also claims that Schwartz promised him she would tear it up later. His share of the estate under the pre-nup is $1.25 million which is in trust.

There are so many fun issues, let’s address a few:

1. The inheritance of the mentally ill son is being challenged under NY’s Slayer Statute which prohibits individuals from inheriting due to killing someone.

2. The ex-husband is not a truly disinterested party in trying to stop his son from inheriting from Mrs. Schwartz. If the committed son does not inherit, his share will go to the share of the son who committed suicide. Because that son is deceased and did not have children, his share will go to his father (the ex-husband).

3. I think that Fischler might have a statue of limitations issue with his challenge to the pre-nup. Post-2008, NY has a 3 year statute of limitations for such challenges which does not apply to prior pre-nups. That statute was six years although it did not start running during the marriage during some areas of NY. Either way, the statute is most likely applicable to challenges from divorce, not death.

4. Fischler’s arguments for contesting the pre-nup seem to be in the “let’s throw a bunch of mud and hope something sticks” vein. The poor legal advice line might work in a death penalty case with a court appointed attorney but should not work in a pre-nup matter where Fischler chose his own attorney. President Trump would likely call Fischler a “loser.”

Photo Credit: Unknown/NY Daily News

License: Fair Use/Education